Off-Plan vs Ready Properties: Which Is the Better Investment in 2025?

Explore off-plan vs ready property investments. Understand prices, payment plans, and market trends to make informed real estate choices in 2025.

Here’s a detailed breakdown of investing in Al Marjan Island (in Ras Al Khaimah, UAE), including opportunities, benefits, risks and key considerations.

If you’d like a tailored analysis (for example: off-plan vs ready, budget range, short-term rental vs long-term hold), I can pull that too.

Here are several positive drivers:

Location & development platform:

Al Marjan Island is a man-made archipelago in Ras Al Khaimah, being developed into a beachfront leisure/residential hub.

Big upcoming infrastructure/resort projects:

A major project is the Wynn Resorts casino-resort (first of its kind in the UAE) on Al Marjan Island, which is expected to boost tourism and thereby demand for property.

Growing capital-value potential:

Some research shows property values on Al Marjan Island could rise significantly in the coming years.

Rental yield potential:

Because of tourism and holiday-home type demand, there is potential for short-term rental income. For example, one source quotes expected ROI of ~6–7% for certain buildings.

Relatively more affordable entry compared to Dubai beachfront areas:

Some commentary suggests that Al Marjan offers “next-door to Dubai” value but at lower cost.

When investing in a project like this, you’ll want to keep these in mind:

Execution risk:

Large-scale development projects (islands, resorts) depend on timelines, quality, and delivery. Delays or lower quality can erode value.

Price growth assumptions:

Some of the high-growth forecasts (e.g., very high per-sq-ft prices) are forward-looking and depend on many variables (tourism growth, regulatory environment, global economic conditions).

For example, one article suggested prices could reach AED 10,000/sq ft by 2030 under optimistic scenarios.

Liquidity / resale risk:

Given this is not yet as established as major Dubai locations, resale may take longer or require a discount if market conditions change.

Rental market competition & regulation:

If many properties come online at once, the supply side may put pressure on yields. Also, holiday-home regulations, occupancy rules, or holiday-rental laws could change.

Location premium vs cost:

While affordability is better than some prime Dubai spots, you will still pay a premium for beachfront/island living — must ensure that premium is justified by demand and yield.

Macro / tourism risk:

The growth depends on tourism arrivals, economic conditions, and UAE’s broader positioning. External shocks (travel bans, economic slowdown) could dampen demand.

Here are some figures for reference:

Some listings show apartments (1–2 bedrooms) on Al Marjan Island for roughly AED 1.1 million to AED 3 million depending on size, view, finish, etc.

ROI examples: One source cites ~6.3% for one building, ~7.1% for another (short-term rental scenario) on Al Marjan.

Off-plan starting prices: Some villas/apartments are being marketed from as low as ~AED 820,000 in Al Marjan Island for smaller units.

Price growth estimations: The perceived current pricing is in the range of AED 1,500–3,000 per sq ft (in early stage) with potential to go higher.

Depending on your goal, you might choose slightly different approaches.

Here are some strategic questions to ask:

Off-plan vs ready:

Buying off-plan gives early entry cost and potential value growth but comes with delivery risk. Ready property has easier rental/income start.

Short-term rental (holiday) vs long-term lease vs own-occupy:

If aiming at high yield, holiday rental may maximize cash-flow but requires property management, marketing, and regulation compliance. Long-term lease is more stable but yield may be lower.

Unit type & view:

A beachfront villa or a branded residence may command a higher premium and higher value growth but cost more and may be harder to rent.

Smaller units (studios/1-bed) often have higher % yield but perhaps less capital growth.

Developer/brand/quality:

A well-known developer or branded residence can reduce risk and appeal to higher-end tenants or buyers in the future.

Exit strategy & timeline:

If you’re investing, consider your holding horizon (5–10 years?), what market you foresee for resale.

Regulatory/holding costs:

Understand service charges, maintenance, holiday-rental licensing, and taxes (though UAE has no property tax, there are other fees: registration, utilities, community fees).

Based on the evidence, investing in Al Marjan Island appears to be a reasonable opportunity with potential upside — especially if you buy in now, with a good developer, good unit, and you’re comfortable with a medium-to-long-term horizon (5–10 years) rather than expecting immediate super-high returns.

However, it is not without risk, and one should not assume guaranteed doubling of value overnight — some of the more optimistic growth projections depend on broader developments (tourism, resort opening, region’s branding) playing out as expected.

If I were advising: make sure you—

Do due diligence on the specific project/developer

Check completion/delivery timelines & guarantee mechanisms

Estimate realistic rental income and yield (after all costs)

Verify your exit/liquidity strategy

Compare to other alternatives (Dubai, other emirates) for cost vs yield vs growth

Explore off-plan vs ready property investments. Understand prices, payment plans, and market trends to make informed real estate choices in 2025.

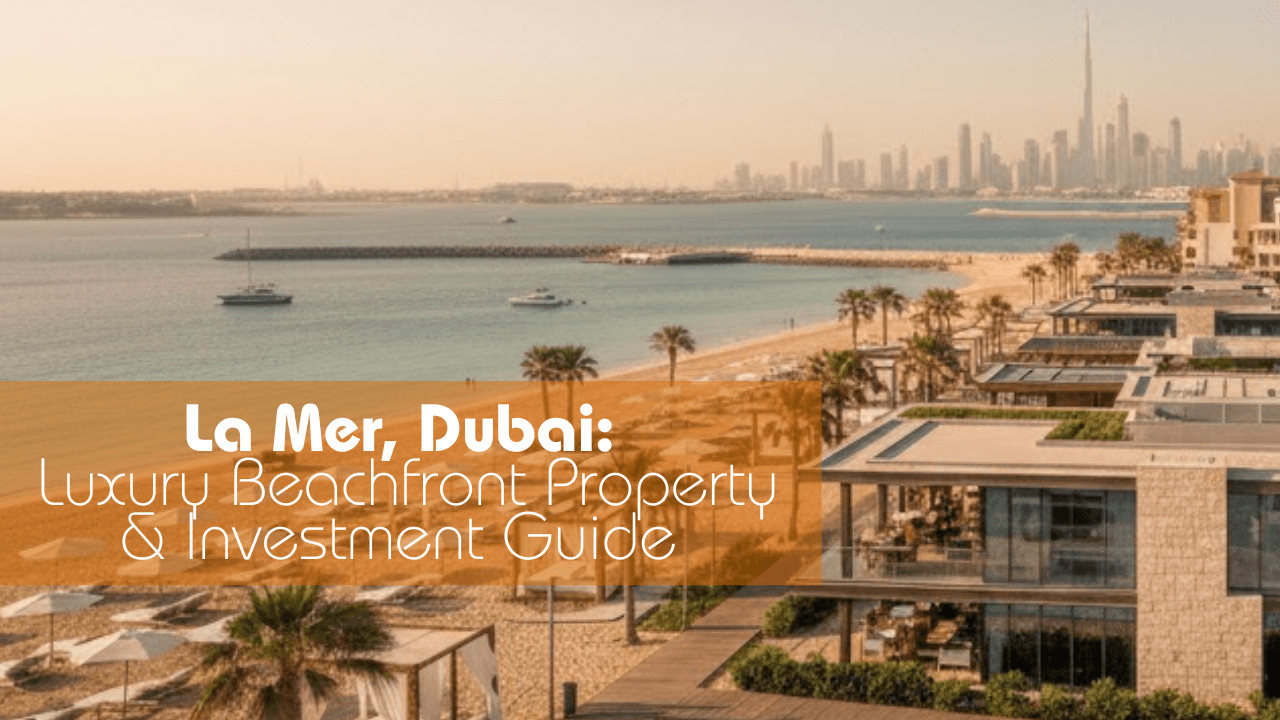

Discover the allure of La Mer, Dubai, one of the city’s most prestigious beachfront communities. Developed by Meraas in Jumeirah 1, La Mer combines luxury residential living with a vibrant seaside lifestyle, offering apartments, townhouses, and villas with stunning Arabian Gulf and marina views.

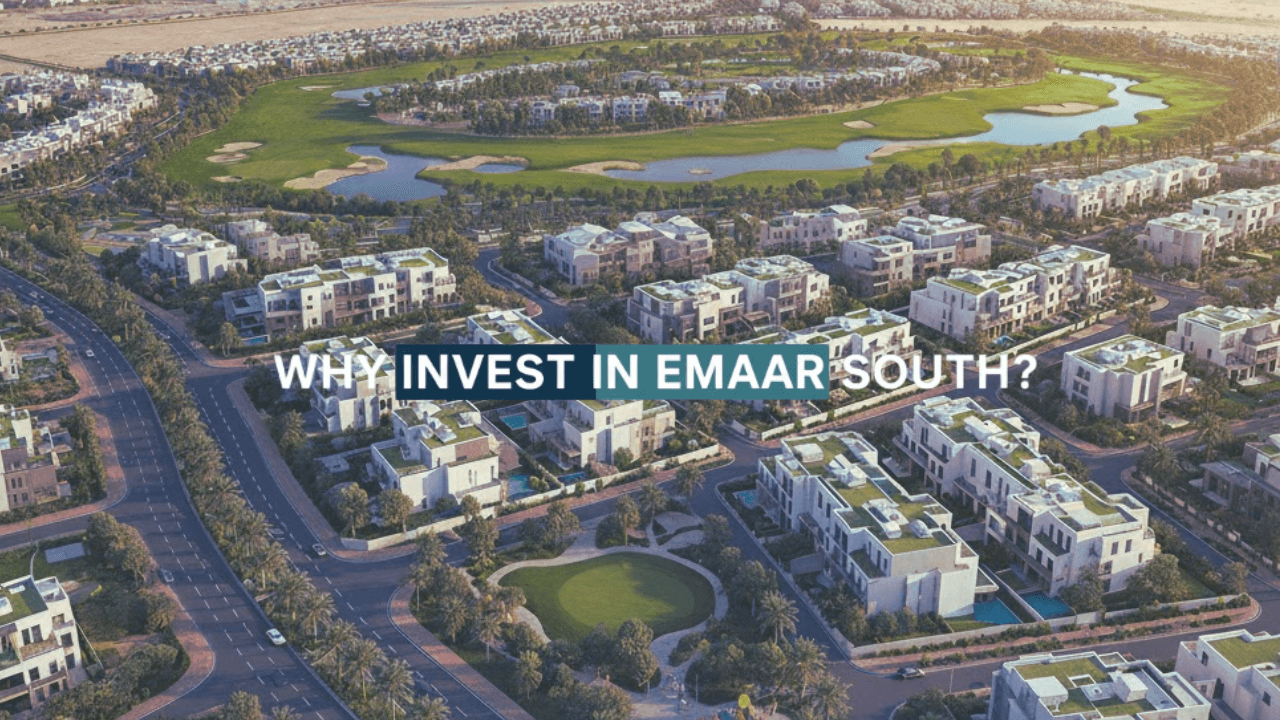

Emaar South in Dubai offers a promising mix of affordable entry prices, modern homes, and long-term growth potential. With proximity to Al Maktoum Airport and Expo City, investors can expect 5–7% rental yields and strong capital appreciation. Ideal for those seeking sustainable ROI in Dubai’s fast-developing southern corridor.

Get in touch with our expert team and let us help you find the perfect property in Dubai. We're here to guide you through every step of your real estate journey.