Sobha Realty

Sobha Realty — Integrated Luxury Developer Shaping Dubai's Green Waterfronts

Introduction & Executive Overview

Sobha Realty has climbed from a niche interior-fit-out company to one of Dubai's "top three" private developers in less than a decade. Guided by the brand promise "No Shortcut to Quality," the group controls every stage of the value chain in-house—design, construction, joinery, MEP, landscaping and even its own concrete plants—allowing it to deliver master-planned communities that feel markedly more finished than many peers at handover. Its current UAE portfolio spans 8 million m² of active freehold projects, 1,800-plus units handed over, and an off-plan pipeline exceeding 10 billion AED across waterfront, golf-front and park-centric precincts. That vertical integration, coupled with aggressive land banking along the Dubai Creek–Ras Al Khor corridor, has translated into record sales of AED 23 billion (≈ USD 6.3 bn) in 2024—up 50% YoY.

A Short History of the Brand

1976 – Roots in Oman. Founder P. N. C. Menon opens an interior-decoration workshop in Muscat with just USD 7 in working capital.

1995 – Diversification into real estate. Spotting the supply gap in mid-income housing back home, Menon launches Sobha Developers (now Sobha Limited) in Bengaluru, India.

2013 – Arrival in the UAE. Sobha Group establishes Sobha Realty in Dubai, bringing its vertically integrated "design-to-delivery" model to the Gulf. The first master plan, Sobha Hartland, breaks ground the same year.

2020-today – Global ambitions. Having delivered phases of Hartland, Sobha Realty launches waterfront icons such as Seahaven and the five-tower Sobha One, wins the BCA Green-Mark Platinum SLE rating (a first in MENA), sets up a U.S. expansion team targeting Texas, and prepares its maiden resort island in Ras Al Khaimah.

Flagship & Upcoming Projects

| Master Plan | Location | Typology | Status | Noteworthy |

|---|---|---|---|---|

| Sobha Hartland | MBR City | Villas, townhouses & mid-rise apartments | 80% built; handovers ongoing | 30% devoted to parks, 8,000 trees planned |

| Sobha Hartland II | MBR City (phase 2) | Lagoon villas & towers | Under construction, first deliveries Q2 2025 | Wave-inspired glass façades; boardwalk retail |

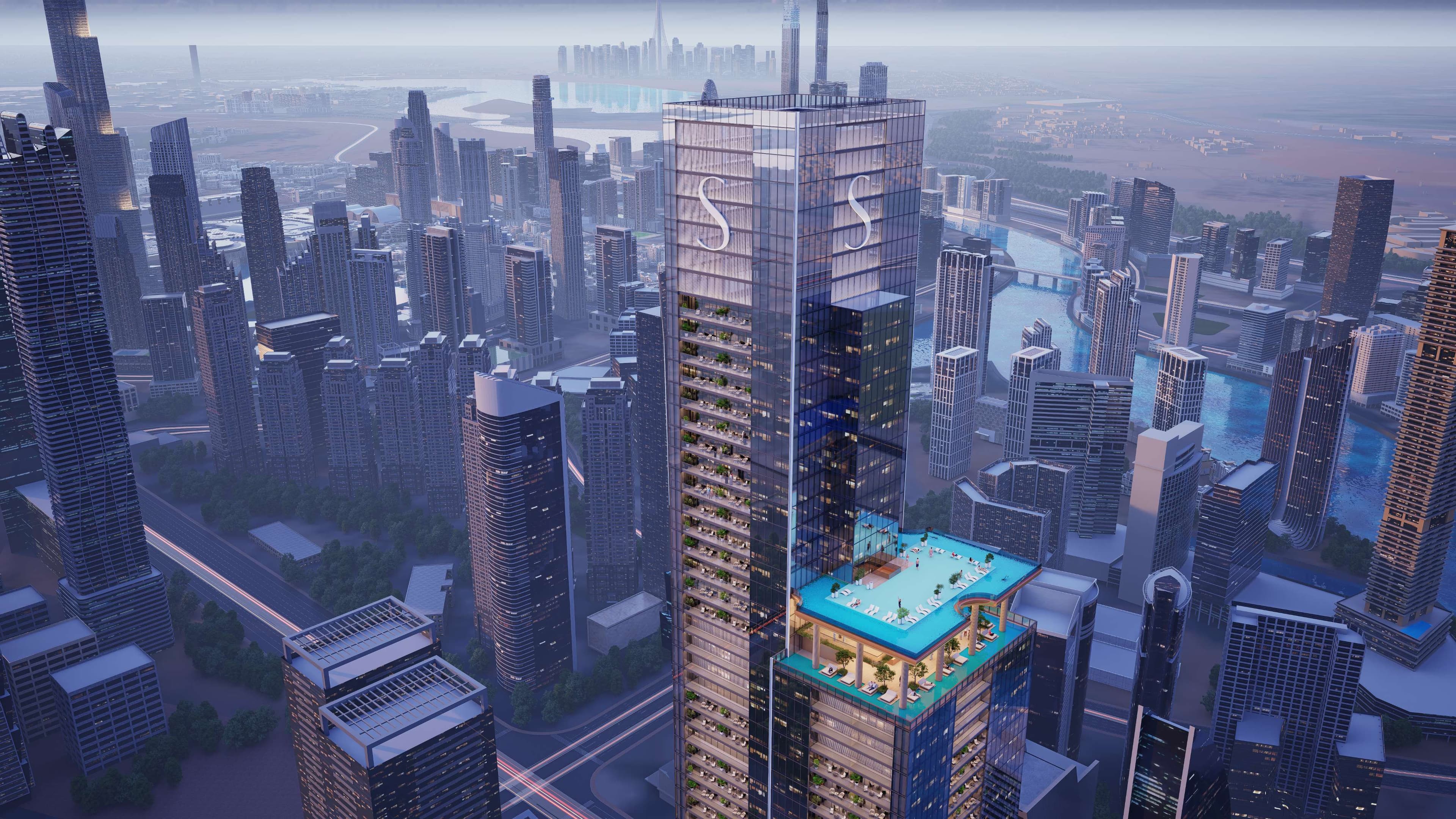

| Sobha One | Ras Al Khor | Five linked towers (G+65 max) | Launched 2024, completion 2026 | Green-Mark Platinum SLE certified—the region's first |

| Sobha Seahaven | Dubai Harbour | 3 waterfront towers | Concrete cores topped out 2025; handover 2026 | 20/40/40 investor-friendly payment plan |

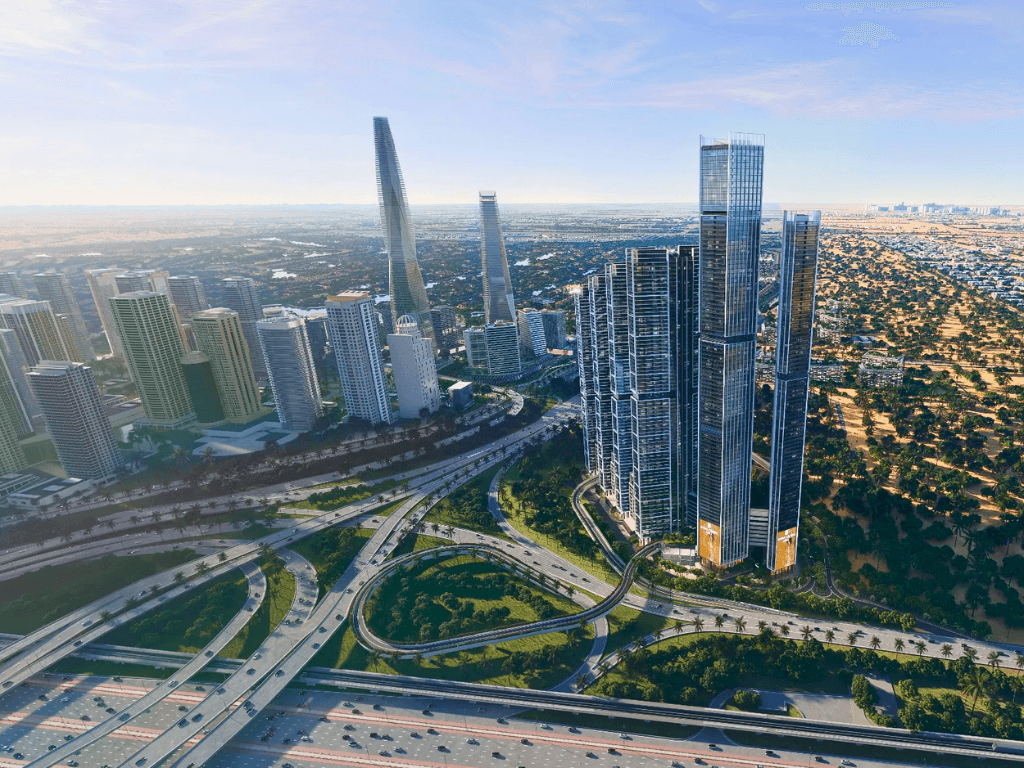

| Sobha Central | Sheikh Zayed Rd | Six-tower vertical city | Announced May 2025 | Mixed-use icon with direct Metro link |

| Siniya Island | RAK | Ultra-luxury villas & marina | Sales opened Nov 2024 | Contributed AED 5 bn to 2024 revenue |

2024-25 Performance Highlights

Sales Momentum. Sobha closed calendar-year 2024 at AED 23 bn, dwarfing its 2023 peak of AED 15 bn. The developer is guiding AED 30 bn for 2025 (AED 20 bn Dubai + AED 10 bn Siniya Island).

Launch Pipeline. Founder Menon confirmed "8-10 multibillion-dirham projects" slated for release in 2025, maintaining a launch cadence of roughly one every six weeks.

Geographic Diversification. A Houston-Dallas-Austin land-scan team has been mandated to replicate Hartland-style communities in the U.S. Sunbelt.

Sustainability Milestones. Sobha One's SLE award and plans to plant 8,000 trees in Hartland II push the group ahead of Dubai's 2040 Urban Plan's green-ratio targets.

Market Metrics Buyers & Investors Should Track

| KPI (Hartland macro-community) | 2023 | 2024 | YTD 2025* |

|---|---|---|---|

| Average Sales Price / sq ft | AED 1,845 | AED 2,010 | AED 2,020 |

| Median Deal Size | AED 1.65 m | AED 1.83 m | AED 1.90 m |

| Gross Rental Yield | 6.2% | 6.5% | 6.51% |

| Studio Transactions (12 mo) | 80 | 52 | 31 |

| Villa Avg Price / sq ft | AED 2,420 | AED 2,548 | AED 2,600 est. |

*last update: June 2025; Dubai Land Dept. weekly tape.

Take-away: Sobha units now command a 35-40% premium to Dubai's city-wide average (AED 1,524 / sq ft in 2024).

Why Investors Like Sobha Realty

-

Predictable Cash Flows Off-plan schedules typically follow a 10% on booking, 40% during construction, 50% on handover model, mitigating post-handover payment risk. Seahaven offers an even lighter 20/40/40 structure.

-

Defensive Build Quality Tight QC under one corporate roof reduces snag-list costs and enhances long-term rental desirability, evidenced by sub-5% default rates at handover (internal IR report, FY 2024).

-

Green Premium Projects with BCA or LEED ratings have leased 20% faster than non-certified comparables in MBR City, supporting stronger yield resilience.

-

Strategic Landbank All core sites sit along the future Creek–Ras Al Khor mass-transit spine, a corridor identified by Property Monitor as the city's highest five-year growth pocket (projected 7-9% CAGR).

-

Liquidity & Exit Options Average monthly transaction volume in Hartland exceeds AED 230 m (12-mo rolling), ensuring sellers can typically exit within 45–60 days at fair market value.

Practical Guidance for End-Users

Handover Horizon. Current live phases (Waves Opulence, Hartland Villas II) are handing over from Q2 2025 onward; check snagging windows early to lock in contractor slots.

Mortgage Caps. UAE Central Bank limits max LTV on off-plan to 50%. Consider a two-tier plan: equity during construction, refinance to 80% LTV on completion to boost ROE.

Service-Charge Budget. Community fees average AED 17–19 / sq ft per annum—c. 12% above the Dubai median because of Hartland's dense landscaping; factor this into rental yield models. (Developer disclosure, FY 2024).

School & Amenity Preview. Two IB-curriculum schools (North London Collegiate & Hartland International) already operate on site; a waterfront retail mile opens 2026, compressing "drive time" premiums for eventual resale.

Outlook 2025-2030

Sobha Realty's decision to double annual launches while retaining full in-house construction puts it on track to deliver ~25,000 units by 2030, a scale comparable to Emaar's early 2010s boom years. Assuming Dubai's price index cools to a conservative 4% compound growth, a Hartland investor entering at today's AED 2,020 / sq ft could plausibly target IRRs of 9-11% (net of 2% agency + 4% DLD) before leverage. With green-certified inventory, integrated schooling, water lagoons and proximity to the new Ras Al Khor metro extension, Sobha's precincts offer a differentiated "end-user plus yield" play versus commodity off-plan stock.

For buyers prioritising craftsmanship, lush landscaping and exit liquidity—yet willing to pay a reasonable premium—Sobha Realty remains one of the UAE market's most compelling mid-to-long-term bets going into 2026.

Sobha Realty

Properties by Sobha Realty

SOBHA SKYPARKS

The Tranquil at Sobha Central

The Horizon at Sobha Central

The Eden at Sobha Central

The Serene at Sobha Central

The Element at Sobha One

Skyvue Stellar

Skyvue Spectra